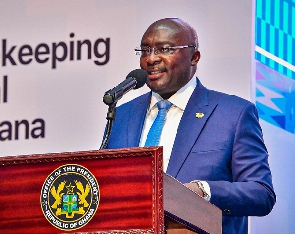

In a bold move that left traditional lenders puzzled, Vice President Dr. Mahamudu Bawumia introduced Asomdwekrom’s newest financial innovation: the national credit scoring system.

Imagine a scenario: a room filled with economists, each equipped with calculators and abacus beads, attempting to assess the creditworthiness of a goat herder in the rural areas.

It’s akin to a mathematical Olympics where the ultimate prize is a favorable interest rate on a loan. Dr. Bawumia’s objective? To establish a standardized approach for evaluating creditworthiness.

Gone are the days of relying on superstitions or astrological signs. Now, every Asomdwekromanian can confidently enter a bank armed with their credit score as a powerful tool.

So, what does this mean for the ordinary citizen? Consider Kwame, a young professional in Accra. Kwame aspires to own a real car, not just a cardboard cutout he pretends to drive.

Previously, without a credit score, Kwame’s chances of securing a car loan were slim. But now, with a positive credit history, Kwame can negotiate interest rates like a seasoned pro.

He’ll be enjoying his morning coffee, content with a 5% APR – just the way he prefers it. But that’s not all! Credit scoring promotes financial responsibility.

It’s akin to having a personal financial advisor at your fingertips. Borrowers become more diligent by paying bills promptly, avoiding impulsive purchases, and resisting unnecessary expenses like that seventh pair of sneakers.

Dr. Bawumia’s initiative signifies a significant shift from informal practices and the outdated “high purchase system.” Previously, credit evaluations lacked consistency, impeding economic progress and restricting access to credit. Now, Asomdwekromanians can anticipate a more dignified and convenient financial journey.

It is essential to confront the significant issue at hand: the unconventional 24-hour economy policy introduced by former President Ogwanfunu.

In contrast to Dr. Bawumia’s credit scoring system, which emphasizes pragmatic solutions, President Ogwanfunu’s proposal appears to stem from a misguided late-night brainstorming session.

The notion of a 24-hour economy under President Ogwanfunu raises concerns. Picture the ensuing disorder! Trotros would be speeding as if in a Formula 1 race, waakye vendors would be serving meals at midnight, and power outages would lead to parties with generators providing the music.

Even the chickens would be perplexed, laying eggs at 3 a.m. However, we can take solace in Bawumia’s credit scoring system, which stands as a pillar of financial rationality.

Let us welcome it as one would a comforting bowl of fufu on a cold Harmattan evening. As dusk settled, Accra morphed into a vibrant nighttime festival.

Trotros, those familiar yet unreliable minibuses, transformed into high-speed vehicles, with drivers embodying the spirit of racing champions. Traffic regulations were disregarded, creating what could only be described as the Osu Grand Prix. Passengers clung tightly to their seats, hoping for divine protection as the trotros maneuvered erratically.

“Hold on tight!” shouted the conductor, his voice drowned out by the symphony of honking horns and cheers fueled by adrenaline. At the same time, on Oxford Street, the waakye establishment, typically a daytime venue, had adapted to the night.

The enticing scent of rice and beans filled the air, competing with the smell of vehicle emissions. Sleep-deprived patrons formed a line, their eyes heavy with fatigue. “I need extra shito!” one customer insisted, seemingly unaware that it was 2 a.m. The waakye vendor complied, her ladle moving with the skill of a seasoned chef.

Subsequently, there emerged the ‘dumsor’ gatherings. Indeed, you read that correctly. These were celebrations ignited by Asomdwekrom’s notorious power interruptions.

Generators roared like ferocious beasts, disrupting the tranquility of the night. “DJ Akosua, increase the voltage!” someone shouted, prompting the generator to respond with a burst of energy. Neon lights flickered, casting surreal shadows across the dance floor. Couples moved in harmony with the rhythm, their actions synchronized with the generator’s sputtering.

It was a romance narrated through volts and kilowatts. Amidst this tumult, Dr. Bawumia’s credit scoring system emerged as a pillar of financial clarity.

Envision a gathering of elders beneath a baobab tree, deliberating on credit scores while sipping palm wine from calabash cups. “My child,” one elder remarked, “your credit score resembles the weather; it is both predictable and enigmatic. Maintain it at a high level, and the doors to loans will swing open.”

The assembly nodded sagely, their wisdom resonating across the savannah. Thus, the people of Asomdwekrom embraced this system as warmly as a bowl of ‘fufu’ on a brisk Harmattan evening.

Gone were the days of erratic payments and uncertainty. Armed with their credit scores, they approached banks with confidence, brandishing their reports like banners of victory.

“I am deserving!” they proclaimed, and the loan officers acknowledged their financial acumen with approval. As dawn broke, the generators quieted, the waakye vendor closed for the day, and the ‘dumsor’ gatherings dimmed their lights. Yet, the credit scoring system stood resolute.

It serves as a silent protector, ensuring that Asomdwekrom’s financial environment remains stable. In the distance, my friend Kofi Django raised his calabash cup, toasting to a future where chickens lay eggs at reasonable hours.

Ultimately, credit scores prevail. They are the unrecognized champions, the guardians of financial stability. Therefore, the next time you review your credit report, acknowledge its significance. In Asomdwekrom, creditworthiness transcends mere numbers; it embodies purchasing power.

In conclusion, credit scores emerge victorious. They are the uncelebrated champions, the defenders of financial security. So, the next time you review your credit report, give it a congratulatory high-five.

In Asomdwekrom, creditworthiness is not just a figure, but also a means of purchasing power. Hence, behold Dr. Bawumia’s groundbreaking credit-scoring transformation.

It signifies progress for Asomdwekrom’s financial industry. Regarding President Ogwanfunu’s 24-hour economy, it seems more fitting for a different realm.

Remember, financial stability is akin to ‘kelewele,’ crispy outside and tender inside. Let us relish it collectively. Until next week for more intriguing gossip, God willing!