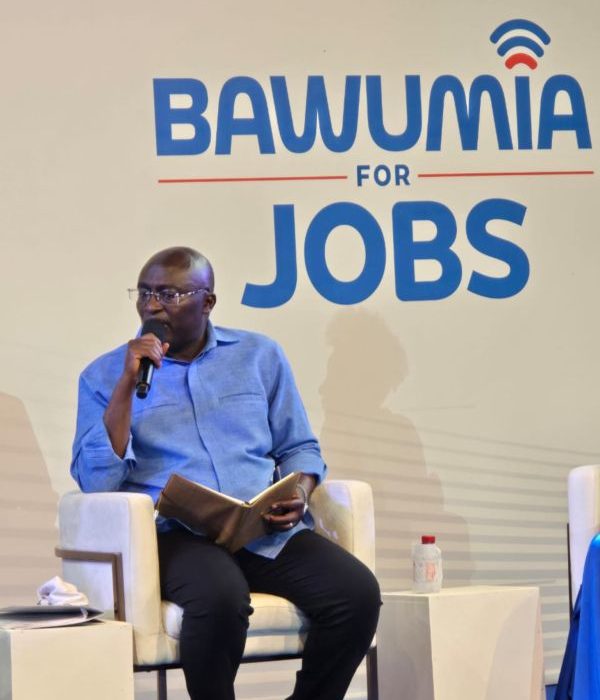

Dr. Mahamudu Bawumia, presidential candidate for the New Patriotic Party (NPP), has reiterated his commitment to introducing a flat tax rate system if elected in the upcoming December 7 election.

Speaking at a youth forum in Accra, Bawumia shared his vision for a simplified tax structure aimed at easing the tax burden on businesses and improving tax compliance for Ghanaians across income levels.

He emphasized that a flat tax rate would provide substantial relief to both individuals and businesses while ensuring the government maintains necessary revenue for vital national initiatives.

Bawumia outlined his administration’s dedication to fostering a business-friendly environment in Ghana—one that encourages economic growth, attracts foreign investment, and eliminates barriers to formalizing businesses.

He argued that a simpler tax structure would boost revenue collection by decreasing incentives for tax evasion and avoidance.

This approach, he suggested, would not only make tax compliance easier for citizens but also strengthen Ghana’s financial foundation, paving the way for sustainable economic growth.

After considering various tax systems, I am convinced that a flat tax is an excellent fit for Ghana. My administration will introduce a straightforward, citizen- and business-friendly flat tax system.

A flat tax will apply as a percentage of income for both individuals and businesses, with an exemption threshold to protect low-income earners. This new system will simplify filing tax returns and address our complex corporate tax and VAT structures.