The Vice President and NPP Presidential Candidate, Dr. Mahamudu Bawumia, has introduced myCreditScore, a tailored credit reference and scoring system designed for Ghanaians.

Supported by the Central Bank, this Credit Scoring System empowers individual Ghanaians to transparently showcase their creditworthiness, thereby facilitating easier access to credit.

This initiative will enable financial institutions to reward individuals who exhibit responsible credit behavior and achieve high scores, allowing them to secure larger credit amounts and reap the benefits of their financial prudence.

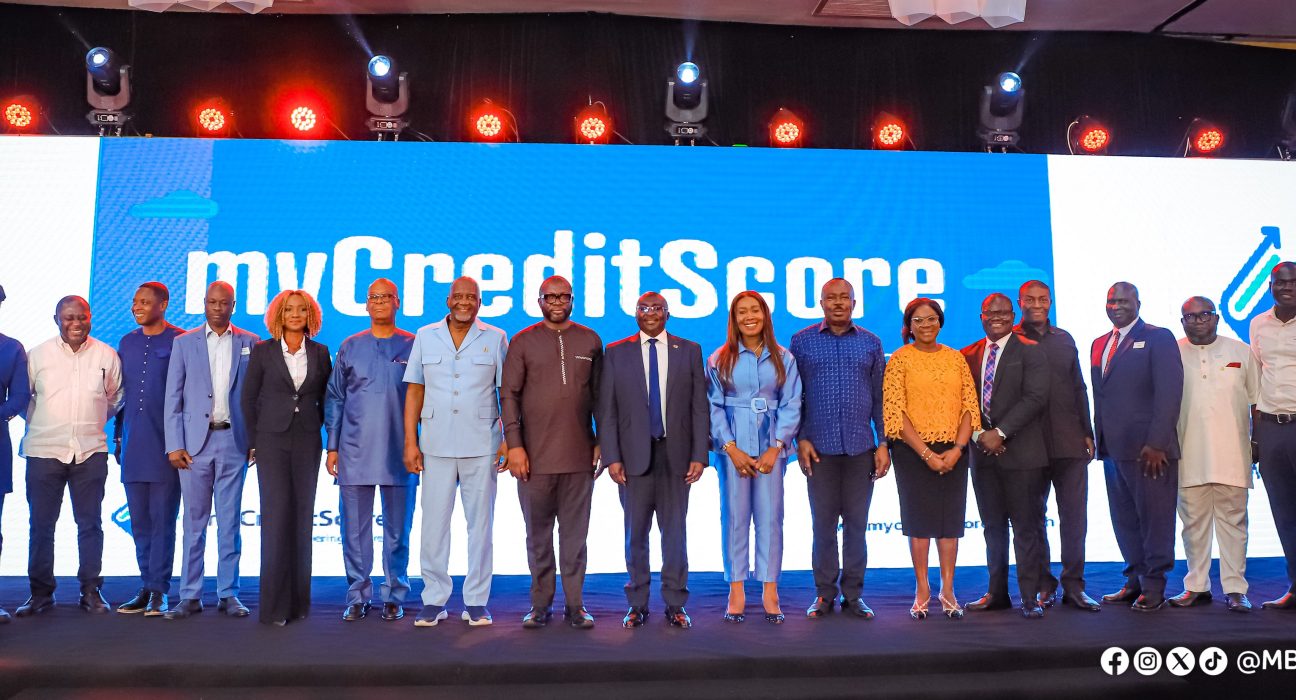

During the launch event held in Accra on Thursday, Dr. Bawumia characterized the credit scoring system as a “significant milestone” and a “progressive step towards establishing a vibrant credit economy for Ghana and its citizens.”

It is a significant milestone in Ghana’s journey towards a financially inclusive and empowered society, yet another chapter in the nation’s ambitious journey towards financial inclusion.

Dr. Bawumia, the leader of the initiative, stated that myCreditScore presents an essential instrument that revolutionizes credit accessibility in Ghana and tackles persistent issues associated with lending and borrowing.

With this system, the financial sector will now have a reliable way to assess the creditworthiness of individuals, a change that is expected to help address high lending rates.

The absence of a credit information system has increased lending risks, leading financial institutions to offer less credit.